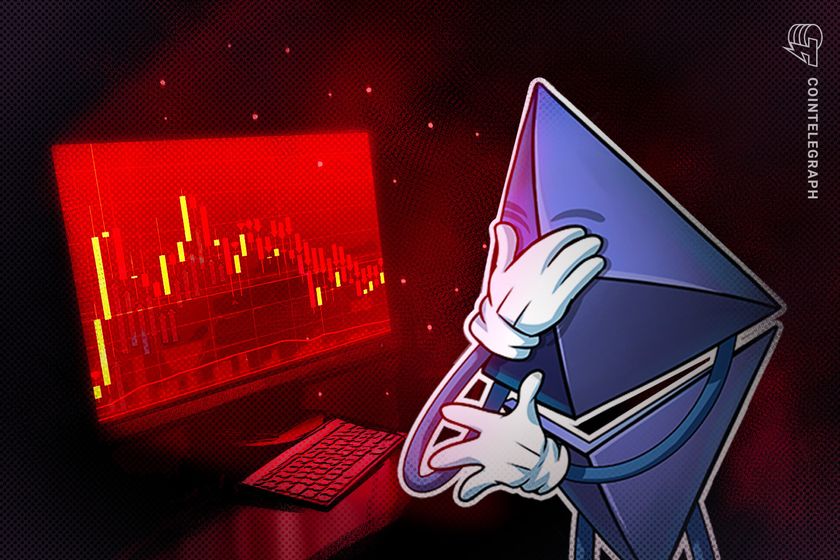

Ethereum Drops 57% from Peak Yet Remains More Valuable Than Toyota

Quick Summary

Ethereum’s price has fallen over 57% from its all-time high, yet its market capitalization remains higher than major global corporations like Toyota, IBM, and Disney. Despite recent declines, Ethereum continues to be valued highly due to its role as critical digital infrastructure and its potential in decentralized finance (DeFi).

Key Points

- Ethereum (ETH) currently trades around $2,088, down from its peak near $4,900 in November 2021.

- Ethereum’s market capitalization stands at approximately $252 billion, surpassing Toyota ($250 billion) and platinum ($245 billion).

- If Ethereum were a company, it would rank as the 50th largest globally, just behind Nestlé.

- Ethereum’s valuation is driven by speculative interest, its role in decentralized finance, and its recent transition to proof-of-stake (PoS).

Ethereum as Infrastructure, Not a Business

Experts emphasize that Ethereum should not be directly compared to traditional companies. Flavio Bianchi, a Polkadot ambassador, explained that Ethereum’s value comes from its role as infrastructure enabling decentralized applications, asset issuance, and transactions without intermediaries.

Is Ethereum Deflationary?

Ethereum recently returned to inflationary status, with an annual inflation rate of about 0.73% over the past month. The network’s inflation or deflation depends on transaction fees burned and new ETH issuance. Fees have significantly dropped recently, reaching their lowest levels since June 2020.

Ethereum’s Market Cap Exceeds GDP of Some Countries

Ethereum’s market capitalization surpasses the GDP of countries like Greece ($243.5 billion) and the combined GDP of Slovenia and Croatia. Analysts see this as a sign of Ethereum’s legitimacy and its potential as foundational infrastructure for future financial systems.

Future Outlook

Industry experts believe Ethereum’s valuation reflects a fundamental shift toward digital infrastructure. Ethereum continues to evolve, with innovations such as native rollups expanding its capabilities and potential use cases.